The Ultimate Guide to Canadian Retirement Calculators 2026

Can You Actually Trust Free Retirement Calculators in 2026?

If you're within 5–15 years of retirement, you've probably tried at least one retirement calculator.

Maybe it was on a bank website. Maybe the Government of Canada. Maybe it promised to tell you—in just a few minutes—whether you're "on track."

You entered your age. Your savings. Your expected retirement date.

A chart appeared. A number. A reassuring (or unsettling) sentence about how long your money might last.

Here's the question most calculators don't invite you to ask:

Can you actually trust what you're seeing?

Retirement Planning Is Harder Now

Not because Canadians are bad at math. Because the rules have changed.

People are retiring later. Living longer. Facing a cost of living that behaves nothing like it did a decade ago. Inflation shocks, uncertain markets, and housing costs have turned what used to be a straightforward problem into a moving target.

That's exactly why retirement calculators have exploded in popularity.

They promise clarity. They promise speed. And—implicitly—they promise accuracy.

Those promises deserve scrutiny.

What's Hiding Behind the Interface

Most free retirement calculators share a common goal: give Canadians a fast, accessible way to estimate future retirement income.

That's a good thing.

The problem is how they get there.

Behind every calculator—no matter how polished—sits a web of assumptions:

- How long you'll live

- How fast your investments will grow

- How inflation will behave

- When you'll take CPP and OAS

- How taxes will affect your withdrawals

Some calculators are transparent about these assumptions. Many are not. And almost none explain how sensitive your result is to small changes in them.

A 1% difference in inflation. A few extra years of life. A slightly different investment return.

Each can dramatically shift the outcome—without changing the headline result enough for you to notice.

The Trust Gap

When most people use a retirement calculator, they assume it's answering a simple question:

"Will I have enough?"

In reality, most calculators are answering something narrower:

"If everything unfolds close to our built-in assumptions, does your plan probably hold together?"

That gap matters.

Some tools assume average life expectancy—meaning roughly half of users will outlive the projection unless they manually adjust it. Others hard-code investment returns, inflation rates, or government benefit amounts you can't change. Many group RRSPs, TFSAs, and non-registered savings together, even though they're taxed very differently.

And most report results in gross dollars, leaving you to guess what your actual spending power might look like after tax.

None of this makes these calculators useless.

But it does mean they're often directional, not definitive.

Why This Matters More as Retirement Gets Closer

If you're 30, a rough estimate is probably fine.

If you're 55 or 60, the margin for error shrinks fast.

Decisions about when to retire, when to take CPP or OAS, how much you can safely spend, whether you can afford to work less—these aren't abstract anymore.

They're imminent.

That's why questions like these deserve real answers:

- How accurate is this retirement calculator, really?

- Are bank retirement tools reliable—or dangerously oversimplified?

- Which calculators let you stress-test assumptions instead of hiding them?

What This Guide Will Cover

This guide exists to answer those questions.

Not from the perspective of a single company or financial institution. From the perspective of Canadians trying to make sense of the tools they're most likely to encounter—and deciding which ones actually deserve their trust.

In the sections that follow, we'll break down:

- What pre-retirees actually want from a retirement calculator

- How popular Canadian calculators really work (banks, government, investment firms)

- Where free tools tend to fall short—and why

- How to use any calculator more intelligently, even within its limitations

Because in 2026, the most dangerous retirement plan isn't the wrong one.

It's the one you think is accurate—but never learned how to question.

What Pre-Retirees Actually Want From a Retirement Calculator

If retirement calculators were judged on features alone, the winner would be whichever one had the longest settings panel.

That's not how real people use them.

Pre-retirees don't wake up thinking, "I'd love to fine-tune a Monte Carlo simulation today." They wake up thinking about decisions. Real ones. The kind that don't fit neatly into a dropdown menu.

So before comparing tools, it helps to be clear about what Canadians approaching retirement are actually trying to answer.

The Questions Behind the Questions

Most pre-retirees don't start with a spreadsheet. They start with unease.

- Can I stop working when I think I can?

- What happens if inflation stays higher than expected?

- Am I going to outlive my savings?

- How much can I actually spend—not in theory, but month to month?

- What breaks if I retire a year earlier… or later?

A good retirement calculator doesn't just produce a number. It helps reduce uncertainty around these questions.

That's the lens we'll use for everything that follows.

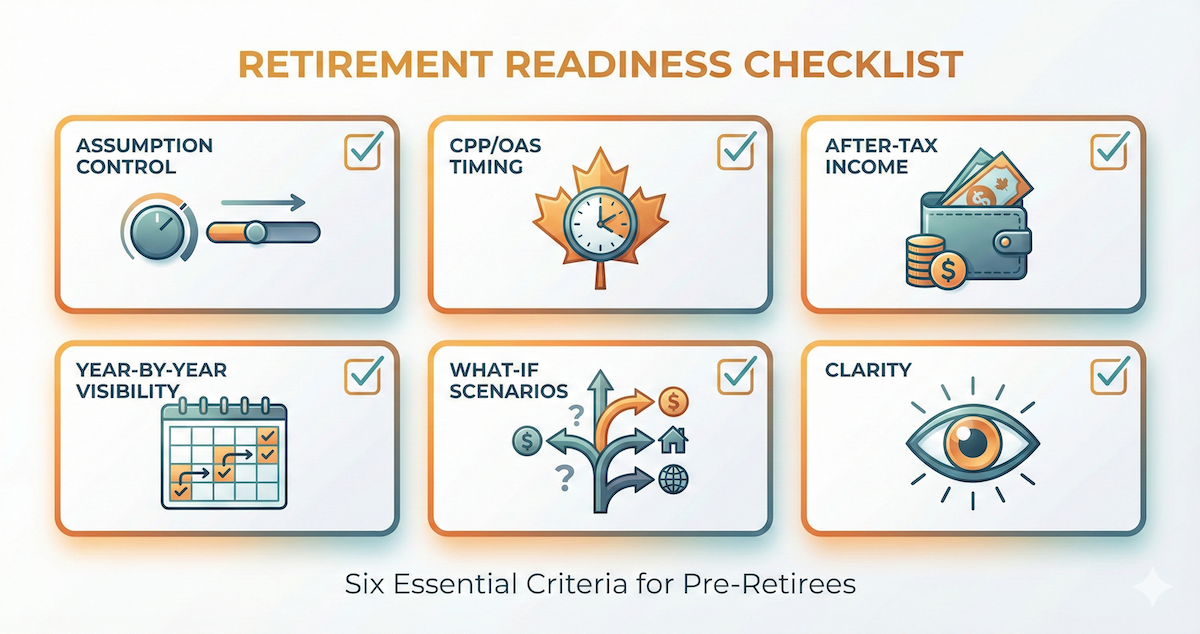

1. Control Over the Assumptions That Matter

At minimum, a trustworthy calculator should let you control the assumptions driving the outcome.

Not hide them. Not lock them in. Control them.

The big three:

Life expectancy — Average life expectancy is just that: average. Planning only to the average means roughly half of people will live longer than the plan assumes.

Investment returns — Returns vary wildly over time. Tools that hard-code optimistic or conservative returns without letting you adjust them remove your ability to stress-test reality.

Inflation — Even small differences compound dramatically over a 25–30 year retirement. If you can't adjust inflation, you're guessing.

If a calculator won't let you touch these assumptions, it's not predicting your future. It's projecting its comfort zone.

2. Real Treatment of CPP and OAS

For Canadians, CPP and OAS aren't side notes. They're foundational.

Pre-retirees want calculators that let them:

- Adjust when CPP and OAS start

- See the impact of delaying benefits

- Understand how government income interacts with personal savings

Tools that assume "average CPP" or hard-code OAS at 65 gloss over one of the most meaningful planning levers Canadians have.

If you can't experiment with timing, you're missing half the story.

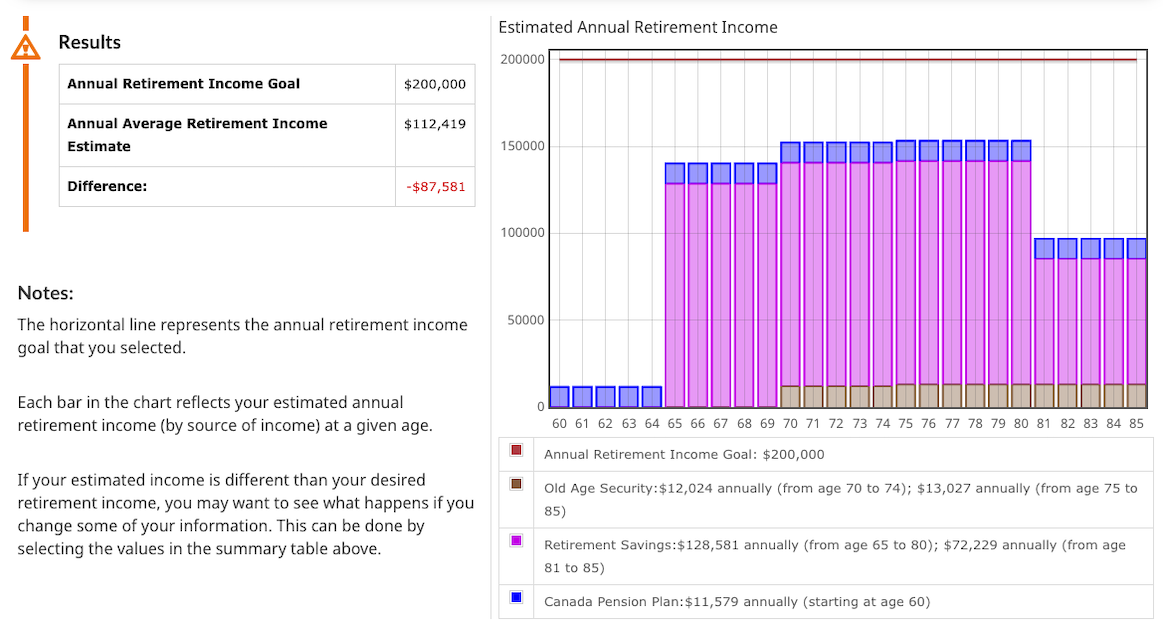

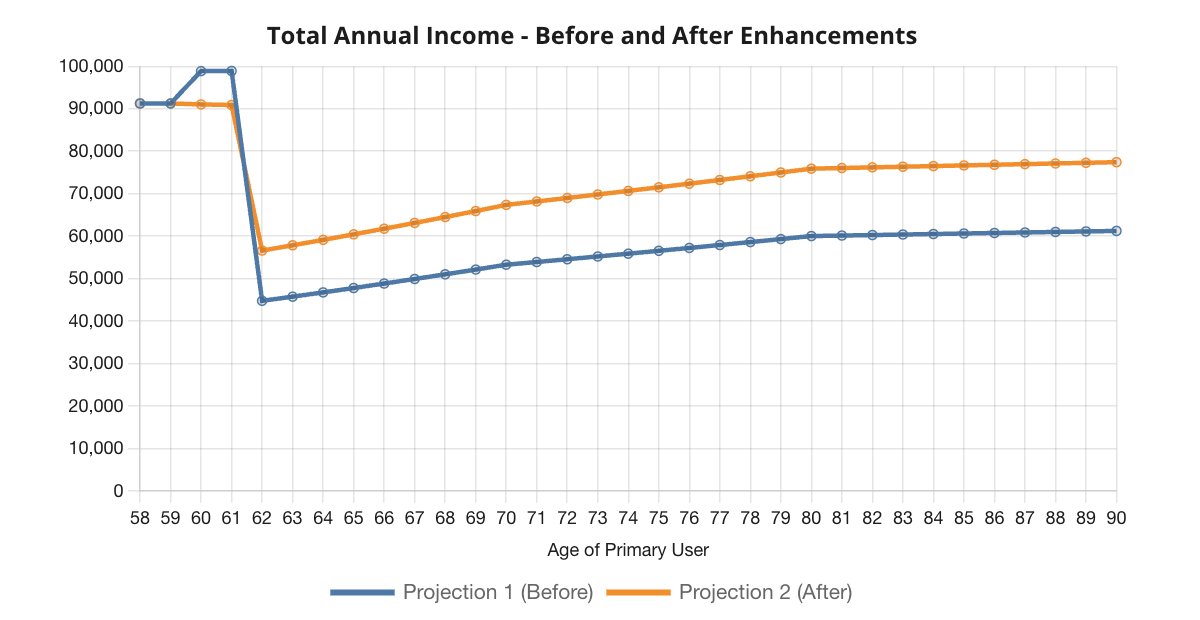

3. After-Tax Income, Not Headline Numbers

This is where many calculators quietly fail.

Most people don't spend gross income. They spend what lands in their bank account.

Yet many tools show results before tax, group RRSPs and TFSAs together, and leave tax impact as an exercise for the reader.

For someone nearing retirement, this matters. A plan that looks fine before tax can feel very different after withdrawals, marginal rates, and clawbacks enter the picture.

Pre-retirees don't need perfect tax optimization. They need a reasonable estimate of spendable income.

4. Year-by-Year Visibility

Trust comes from transparency.

Calculators that show only a final balance or a single line chart ask users to take too much on faith.

Pre-retirees want to see how income changes over time. When savings start declining. What happens in their 70s, 80s, and beyond.

Year-by-year projections don't need to be overwhelming. But without them, it's impossible to tell why a plan works—or where it breaks.

5. The Ability to Test "What If" Scenarios

Life doesn't unfold in a straight line.

Good calculators recognize that by letting users test scenarios like:

- Retiring a year earlier or later

- Spending more in early retirement, less later

- Adding or removing part-time income

- Accounting for a home sale, inheritance, or major expense

This isn't about perfection. It's about flexibility.

If a tool can't handle small changes without falling apart, it's fragile. And fragile plans don't inspire confidence.

6. Clarity Over Cleverness

Finally, usability matters.

A calculator can be technically sophisticated and still fail its audience if inputs aren't clearly explained, outputs aren't interpretable, or users can't tell what changed when they adjust something.

Pre-retirees don't want to learn the tool. They want the tool to help them think.

That doesn't mean dumbing things down. It means respecting the reader's time and intelligence.

The Takeaway

When Canadians search for "retirement calculator accuracy" or "are bank retirement tools reliable," they're not hunting for the fanciest model.

They're looking for reassurance—grounded in reality.

In the next sections, we'll put the most popular Canadian retirement calculators to this standard. Not to crown a single winner. But to show what each tool is actually built to do—and where its limits begin.

Government & Bank Retirement Calculators: What They're Built For

Before critiquing government and bank retirement calculators, let's state something plainly:

These tools aren't bad.

They're just built for a very specific job—and problems arise when Canadians expect them to do more than that job allows.

Why These Calculators Exist

Government and bank retirement calculators are designed to be:

- Widely accessible

- Fast to complete

- Low-friction

- Safe from a compliance perspective

They're meant to answer a broad, public-facing question:

"Am I roughly on track, assuming a typical retirement?"

That framing matters. Once you understand the design constraints, the limitations start to make sense.

Government of Canada: Credible, Conservative, Intentionally Generic

The federal government's retirement income tools are often the first calculators Canadians encounter.

They carry institutional credibility. They're free. They're grounded in official CPP and OAS rules.

That's the upside.

The tradeoff is conservatism.

Government calculators tend to assume average life expectancy by default, use standardized assumptions for inflation and returns, and focus on baseline income adequacy—not optimization.

From a policy perspective, this is deliberate. The government's job isn't to help you maximize outcomes. It's to ensure citizens can estimate whether public benefits and personal savings might cover basic needs.

For early-stage planning, that's useful.

For someone 5–10 years from retirement making irreversible decisions, it's often not enough.

The calculator isn't asking your questions. It's asking the government's.

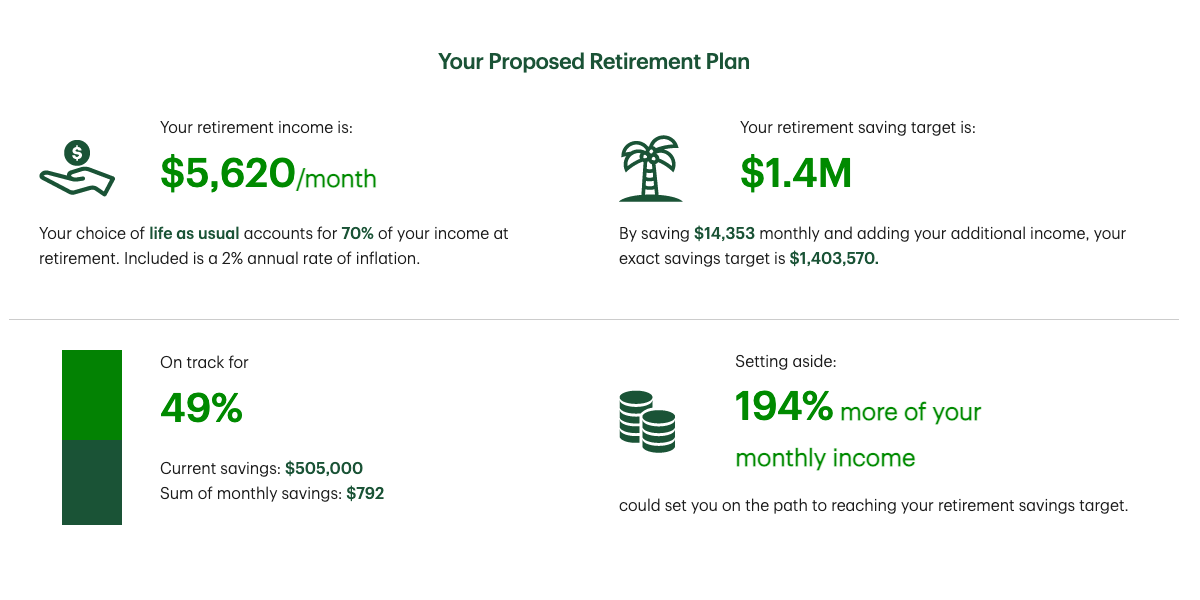

Bank Calculators: Simplicity Over Specificity

Bank retirement calculators follow a similar philosophy with a different incentive structure.

They're designed to engage customers, encourage saving behavior, and provide reassurance without overwhelming.

To achieve that, banks simplify aggressively.

Common patterns include:

- Pre-set income replacement targets (often 60–80% of pre-retirement income)

- Fixed assumptions for investment returns and inflation

- Limited or no control over CPP and OAS timing

- All savings grouped into a single bucket

From a usability standpoint, this works. You can complete most bank calculators in under five minutes.

From a planning standpoint, the simplicity comes at a cost.

The Hidden Constraint: Compliance and Risk

One reason bank tools look so similar across institutions isn't coincidence.

It's risk.

Banks are cautious about providing outputs that could be interpreted as personalized financial advice. That caution shows up as narrow input ranges, conservative assumptions, and few levers to pull.

The calculator is designed to avoid being wrong—even if that means being imprecise.

That's understandable. It's also why many bank tools feel oddly rigid when you try to stress-test them.

Where These Tools Work Well

Used appropriately, government and bank calculators are good at:

- Establishing a rough savings target

- Encouraging people to think about retirement earlier

- Highlighting obvious gaps between current savings and future needs

For someone decades away from retirement, that's often sufficient.

These tools are entry points. Not endpoints.

Where They Fall Short for Pre-Retirees

As retirement approaches, the questions change.

Pre-retirees aren't asking, "Should I save more?"

They're asking:

- When can I safely stop working?

- How much can I actually spend each year?

- What happens if markets disappoint early in retirement?

- Does delaying CPP materially improve my plan?

Most government and bank calculators aren't built to answer those questions.

They often hide or lock critical assumptions, report gross income without tax context, provide little or no year-by-year visibility, and make it difficult to test alternative retirement ages or spending paths.

The result isn't misinformation.

It's false confidence.

A plan can look "fine" inside a simplified model—and feel very different when real-world complexity shows up.

The Takeaway

Government and bank retirement calculators play an important role. They lower the barrier to entry. They normalize retirement planning. They help Canadians get started.

But for pre-retirees relying on them as decision-making tools, it's important to recognize what they're optimized for—and what they intentionally avoid.

In the next section, we'll look at a different category of calculators. Ones built not just to reassure—but to explore. Where flexibility begins to replace simplicity.

Investment Firms, Robo-Advisors, and "Better-Than-Average" Calculators

Once Canadians move beyond government and bank tools, they land in a second tier of retirement calculators.

These are typically offered by investment management firms, robo-advisors, fintech platforms, and independent planners.

They share a common trait: they assume the user wants—and can handle—more nuance.

That shift changes everything.

What Distinguishes This Category

Compared to government and bank calculators, these tools generally offer more adjustable assumptions, greater visibility into how results are calculated, and some recognition that retirement isn't a single, static outcome.

They're designed less to reassure and more to explore.

But that added power comes with tradeoffs.

Desjardins: Detail Without Intimidation

Desjardins' retirement calculator stands out for balance.

It offers more control and transparency than most bank tools without tipping into overwhelming complexity.

Notable strengths include adjustable CPP and OAS start ages, reasonable default assumptions that can be overridden, and clear year-by-year projections of retirement income.

For many pre-retirees, this is the first calculator that feels like it's showing its work.

The limitations are instructive. Results are still presented in gross dollars, which means users must mentally translate income into spending power. And like many tools, it assumes pensions are fully indexed to inflation unless told otherwise.

Still, as a free calculator, Desjardins represents a meaningful step up from entry-level tools.

Mawer: After-Tax Focus, With Guardrails

Mawer's calculator takes a different approach.

Instead of asking how much income you'll generate, it starts with how much you want to spend—after tax.

That distinction matters.

By framing the problem around spendable income, the tool aligns more closely with how people actually experience retirement.

Other strengths include transparency around assumptions, the ability to model one-time cash flows, and a clear link between savings, withdrawals, and sustainability.

The constraints are subtle but important. Life expectancy is fixed. Investment return ranges are narrow. Users must manually input certain government benefits.

Mawer's tool feels cautious by design—helpful for conservative planning, less useful for wide-ranging scenario testing.

Steadyhand: Maximum Control, Maximum Responsibility

Steadyhand's retirement simulator pushes flexibility further than almost any free tool in Canada.

Users can assign different inflation rates to different income sources, change spending levels over time, and fine-tune assumptions with unusual precision.

For analytically minded pre-retirees, this is powerful.

For others, it can feel like being handed the cockpit of a plane.

The simulator assumes a high level of financial literacy. Small input errors can materially change outcomes. And despite the sophistication, savings are still largely grouped rather than modeled by tax treatment.

Steadyhand rewards engagement—but demands it.

Wealthsimple: Frictionless, But Tightly Constrained

Wealthsimple's retirement calculator sits at the opposite end of the spectrum.

It's fast. Visually polished. Intentionally minimal.

For users seeking a quick snapshot, that's appealing. But the simplicity is enforced.

Key assumptions—including investment returns and government benefit levels—are largely fixed. Users can't meaningfully stress-test scenarios. Outputs are high-level, with little insight into year-by-year dynamics.

Wealthsimple's tool is best understood as a conversation starter, not a planning engine.

PERC and Research-Driven Tools

Some calculators are built not by institutions but by researchers and planners focused on risk.

The Personal Enhanced Retirement Calculator (PERC) is a good example. Rather than optimizing for upside, PERC emphasizes sustainability under conservative assumptions. It compares income paths under different drawdown philosophies, including annuitization.

The tradeoff is usability. Users must source and input detailed information, including CPP estimates from external sources. The outputs can feel abstract to those unfamiliar with actuarial framing.

These tools are valuable—but best suited to users willing to invest time and mental energy.

Fidelity and Similar Firm Calculators

Investment firms like Fidelity offer retirement calculators designed to engage a broad audience.

They tend to strike a middle ground: more detailed than bank tools, less flexible than planner-grade software.

Often the result is a "score" or readiness indicator rather than a full cash-flow projection. Useful for benchmarking. Limited for decision-making.

The Pattern That Emerges

As calculators become more flexible, three things happen simultaneously:

- Accuracy potential increases

- Cognitive load rises

- Responsibility shifts to the user

There's no free lunch.

Better tools don't eliminate uncertainty—they expose it.

The Takeaway

This second tier of calculators is where many pre-retirees get stuck.

They're clearly better than entry-level tools. But they still require interpretation, judgment, and context.

Some favor simplicity. Others favor control. None fully solve the problem on their own.

In the next section, we'll step back and look at the shared weaknesses that cut across all free retirement calculators—regardless of category.

Because understanding those limits is what separates informed planning from misplaced confidence.

Where Free Retirement Calculators Commonly Go Wrong

By now, a pattern should be emerging.

It doesn't matter whether a calculator comes from the government, a bank, an investment firm, or a well-meaning researcher. The same structural weaknesses show up again and again.

Not because the builders are careless—but because modeling retirement is genuinely hard, and free tools have limits.

Understanding those limits is what separates useful guidance from false confidence.

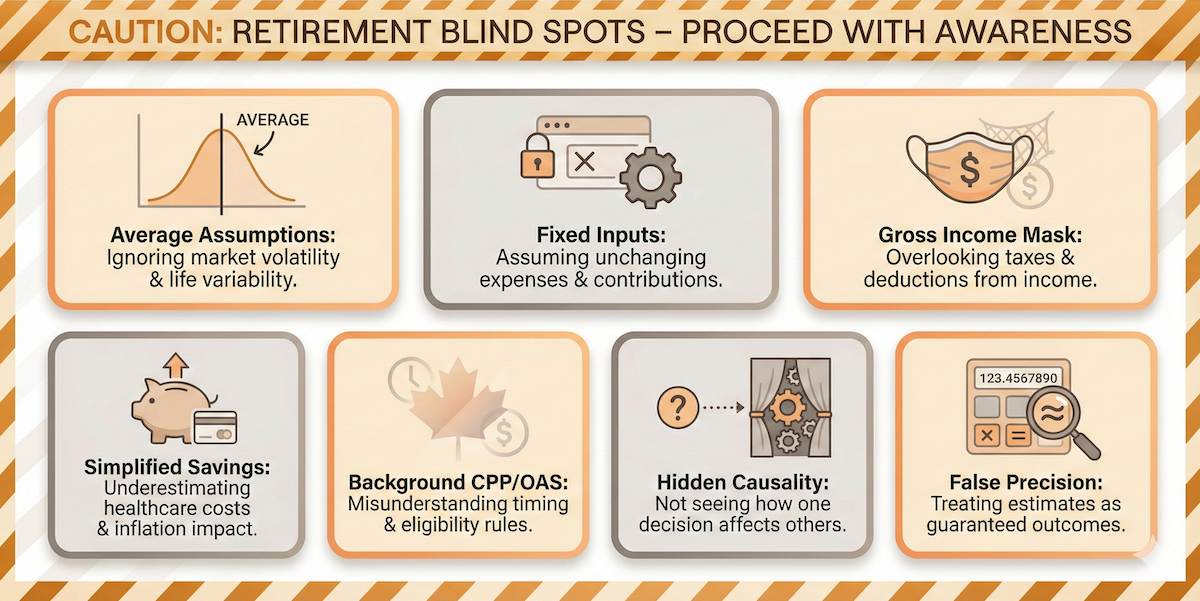

1. Average Assumptions Applied to Non-Average Lives

Many calculators quietly plan to the "average" outcome. Average life expectancy. Average inflation. Average market returns.

The problem is statistical, not theoretical.

Roughly half of Canadians will live longer than average. Many will experience long stretches of unusually high or low inflation. Markets will not deliver smooth, linear returns.

A calculator that plans only for the midpoint is implicitly saying: "If things unfold normally, you're fine."

But retirement risk lives in the tails. And most calculators don't let you explore them.

2. Fixed Assumptions That Can't Be Stress-Tested

Some tools are transparent about their assumptions but don't let you change them. Others don't surface assumptions at all.

Either way, the result is the same: you can't test resilience.

If you can't ask—

- What if returns are lower for the first five years?

- What if inflation stays elevated longer than expected?

- What if I live to 95 instead of 85?

—then you're not planning. You're accepting a single narrative.

Stress-testing isn't pessimism. It's prudence.

3. Gross Income Masquerading as Spending Power

This is one of the most common—and consequential—blind spots.

Many calculators report retirement income before tax. That number feels concrete.

It isn't.

Taxes, clawbacks, and withdrawal sequencing materially affect what retirees can actually spend. A plan that looks healthy at $70,000 gross can feel tight at $55,000 net.

When calculators ignore that translation, they shift risk onto the user.

4. Oversimplified Treatment of Savings and Withdrawals

RRSPs, TFSAs, and non-registered accounts behave very differently in retirement. Yet many tools lump them together.

That simplification hides tax timing effects, the impact of mandatory RRIF withdrawals, and opportunities to smooth income across years.

As a result, calculators often show whether money runs out—but not how it runs out.

For pre-retirees, that distinction matters.

5. CPP and OAS Treated as Background Noise

Government benefits are often treated as static inputs. Average CPP. Standard OAS at 65. Minimal interaction with the rest of the plan.

In reality, CPP and OAS timing decisions can meaningfully reshape retirement cash flow—especially when paired with RRSP drawdowns or bridge income.

Tools that don't let users explore these interactions flatten one of the most important planning levers Canadians have.

6. No Visibility Into Why the Result Looks Good (or Bad)

Many calculators are outcome-focused. You get a number. A graph. A "success" or "shortfall" message.

What you don't get is causality.

Why does the plan work? Where does it strain? Which assumption is doing the heavy lifting?

Without that visibility, users can't build intuition—only dependence.

7. Precision Without Accountability

Some calculators feel sophisticated because they produce precise outputs. Decimals. Exact ages. Long projections.

Precision creates trust. But without clarity around assumptions and mechanics, it can be misleading.

A detailed answer to the wrong question is still the wrong answer.

The Deeper Issue

None of these flaws are fatal on their own.

The real risk emerges when they compound.

A fixed life expectancy plus gross income reporting plus simplified taxes plus limited scenario testing can produce a plan that looks robust—right up until it isn't.

That's not a failure of technology. It's a reminder that calculators are models. And models are only as honest as the questions they allow you to ask.

The Takeaway

Free retirement calculators are powerful tools—when used with clear eyes.

They're best treated as exploratory instruments, educational frameworks, and conversation starters.

They're weakest when treated as verdicts.

In the next section, we'll flip the lens. Instead of focusing on what calculators get wrong, we'll look at how Canadians can use any retirement calculator more intelligently—even within its limitations.

How to Use Any Retirement Calculator More Intelligently

At this point, it should be clear that no retirement calculator—free or otherwise—can give you certainty.

That doesn't make them useless. It just means they need to be used differently than most people expect.

When used well, retirement calculators can sharpen judgment, surface trade-offs, and reduce blind spots. When used poorly, they provide comfort without understanding.

The difference isn't the tool. It's the approach.

1. Treat the First Result as a Hypothesis, Not a Verdict

The most common mistake is stopping at the first output.

A chart appears. A message says you're "on track"—or not. And the session ends.

Instead, think of the first result as a working hypothesis:

"This outcome is true if the assumptions hold."

Your job is to find out how fragile that outcome is.

2. Interrogate the Assumptions Before Trusting the Answer

Before reacting emotionally to a result, look for the assumptions driving it.

Ask yourself:

- What life expectancy is being assumed?

- What investment return is baked in?

- What inflation rate is implied?

- Are CPP and OAS treated as adjustable or fixed?

If you can't find the assumptions, assume they're doing more work than you think.

3. Run at Least Three Scenarios

One projection is noise. Three tell a story.

If the calculator allows it, try:

- A baseline scenario using reasonable assumptions

- A conservative scenario with lower returns, higher inflation, and longer life

- An optimistic scenario that reflects things going right

What matters isn't which one looks best. It's how far apart they are.

Wide gaps signal risk. Narrow gaps signal resilience.

4. Focus on Spending Power, Not Account Balances

Large account balances feel reassuring. They're also abstract.

What actually matters in retirement is how much you can spend, when that spending might need to change, and whether it holds up late in life.

If a calculator only reports gross income or ending balances, do the extra work to translate that into realistic spending.

A smaller, stable spending number is often safer than a larger, fragile one.

5. Pay Attention to When Things Happen—Not Just If

Sequence matters.

A plan that works on paper can still fail if markets underperform early in retirement, withdrawals ramp up too quickly, or government benefits are taken too early or too late.

Use year-by-year outputs to look for stress points. Where does the plan feel tight? Where does it relax?

Those inflection points are more informative than the final outcome.

6. Use Calculators to Compare Decisions, Not Predict the Future

Retirement calculators are better at comparing paths than forecasting outcomes.

For example:

- Retire at 62 vs. 64

- Take CPP at 60 vs. 70

- Spend more early vs. preserve later

If one choice consistently dominates across scenarios, it's probably directionally sound. If outcomes flip based on small assumption changes, caution is warranted.

7. Cross-Check With More Than One Tool

Different calculators make different simplifying assumptions.

Running your numbers through two or three tools isn't redundancy. It's validation.

If all tools point in the same direction, confidence increases. If results diverge wildly, that's a signal—not a failure.

It means the situation is sensitive and deserves deeper thought.

8. Remember What Calculators Can't See

No calculator knows your health trajectory, your tolerance for uncertainty, your willingness to adjust spending, or how flexible your work and lifestyle might be.

Those variables matter as much as returns and taxes.

Treat calculators as quantitative inputs—not replacements for judgment.

The Takeaway

Used thoughtfully, retirement calculators can make complex trade-offs visible. They can clarify choices. They can prevent obvious mistakes.

What they can't do is absolve you of thinking.

The goal isn't to find a calculator that feels comforting. It's to use tools that help you ask better questions.

In the final sections, we'll bring everything together—including how to close the gaps that calculators inevitably leave behind.

Retirement Calculators in Canada: FAQs That Actually Matter

This guide has covered a lot of ground.

But if you strip retirement planning down to the questions Canadians are actually typing into Google, a familiar pattern emerges.

Here are the answers—without fluff—to the questions that come up most often.

What is the best free retirement calculator in Canada?

There isn't a single "best" calculator for everyone. Different tools are built for different purposes.

Government and bank calculators work well for early-stage planning and rough benchmarks. Investment firm and planner-style calculators offer more control and transparency but demand more engagement.

If you're 10+ years from retirement, a simpler tool may be sufficient. If you're within a decade, calculators that allow assumption changes, year-by-year projections, and CPP/OAS timing flexibility are generally more useful.

The most reliable approach isn't picking one tool—it's understanding what each tool is designed to do.

Are retirement calculators accurate?

Retirement calculators are directionally accurate—not precise predictors.

They model outcomes based on assumptions. If those assumptions hold, the output may be reasonable. If they don't, the result can drift—sometimes dramatically.

Accuracy improves when assumptions are transparent, inputs are adjustable, and results can be stress-tested.

Calculators are best used to compare decisions, not forecast exact outcomes.

Are bank retirement tools reliable?

Bank retirement calculators are reliable for what they're intended to do: encourage saving, provide high-level estimates, and reduce planning friction.

They're less reliable for detailed decumulation planning, tax-aware spending projections, or CPP/OAS optimization.

Think of them as safe entry points—not final answers.

How often should I rerun a retirement calculator?

At minimum, revisit your projections:

- Annually

- After major market swings

- After life events (career shifts, inheritance, downsizing)

Retirement planning isn't static. Neither should your projections be.

Why do different calculators give different answers?

Because they make different simplifying assumptions.

Common differences include life expectancy, investment return models, inflation treatment, tax handling, and CPP/OAS assumptions.

Divergent results aren't a sign that one calculator is "wrong." They're a signal that the situation is sensitive to assumptions.

That sensitivity is information.

Should I trust a single calculator?

No.

Use calculators as lenses, not oracles.

If multiple tools point in the same direction, confidence increases. If they diverge, slow down and understand why.

Do I need a financial planner if I use a calculator?

That depends on complexity.

Calculators are excellent for exploring scenarios and building intuition. They struggle with tax sequencing, benefit coordination, and trade-offs that play out across decades.

For straightforward situations, calculators may be enough. For complex or high-stakes decisions, professional advice can add value—especially when paired with solid modeling.

The two aren't mutually exclusive. The best outcomes often come from using calculators to educate yourself, then refining the plan with professional guidance.

The Takeaway

Search engines reward certainty. Retirement planning rarely offers it.

The most useful calculators don't eliminate uncertainty—they help you understand it.

That's the mindset that leads to better decisions.

What Retirement Calculators Can't Do—and How to Close the Gap

Even the best retirement calculators eventually hit a wall.

Not because they're poorly designed. But because some aspects of retirement planning resist automation.

Understanding where calculators stop being helpful is just as important as knowing where they excel.

What Calculators Consistently Struggle With

Most calculators have difficulty modeling:

- Withdrawal sequencing across account types

- Tax efficiency over time, not just in a single year

- CPP and OAS coordination with drawdown strategies

- Behavioral flexibility, like adjusting spending dynamically

- Trade-offs between certainty and upside

These aren't edge cases. They're core planning questions—especially for Canadians approaching retirement.

The Gap Between Projection and Planning

Calculators are excellent at projecting outcomes.

Planning requires something more. It requires judgment.

Knowing when to spend aggressively and when to preserve capital. Understanding how early retirement years affect late-life security. Recognizing when marginal tax optimization meaningfully improves outcomes—and when it doesn't.

These decisions depend on priorities, not just math.

Why Better Modeling Doesn't Eliminate Uncertainty

It's tempting to think that adding more inputs solves the problem. More precision. More sliders. More charts.

But precision without interpretation can create a false sense of control.

Better tools don't remove uncertainty. They make it visible.

That visibility is valuable—but only if paired with thoughtful interpretation.

How Canadians Actually Close the Gap

In practice, people bridge the limits of calculators in a few ways:

- Using multiple tools to triangulate outcomes

- Layering tax awareness onto gross projections

- Stress-testing plans for downside resilience

- Revisiting decisions regularly as circumstances change

Some choose to work with fee-only planners. Others rely on more advanced planning platforms that integrate cash flow, taxes, and scenario testing more deeply.

The approach matters less than the mindset.

The Real Goal

The goal of retirement planning isn't to find the perfect calculator.

It's to build a plan that survives uncertainty, adapts to change, and reflects real priorities.

Calculators are tools. Powerful ones. But they work best when treated as part of a broader thinking process—not the end of it.

Final Thought

If this guide has done its job, you should feel less focused on which calculator to trust—and more confident about how to evaluate any of them.

That skill matters more than any single output.

Because the strongest retirement plans aren't built on perfect predictions.

They're built on informed decisions.

Enjoyed this article?

A quick like helps others discover it too.